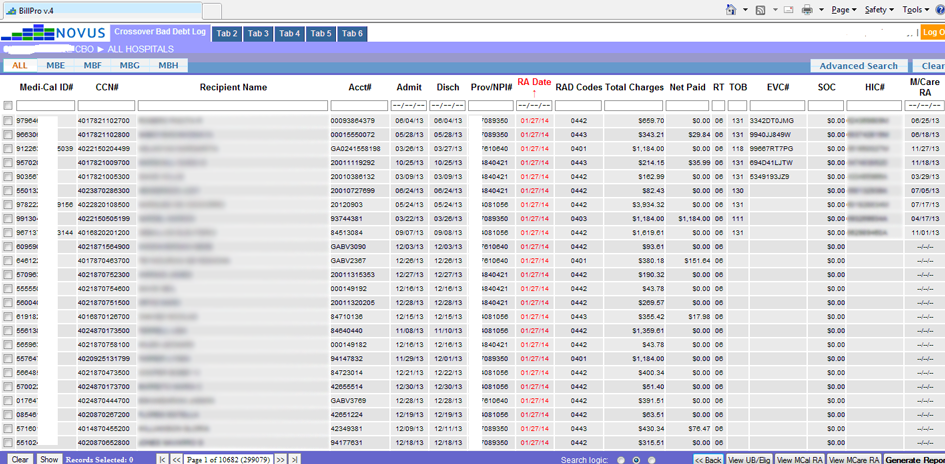

Medicare Bad Debt Log

The ‘Bad Debt Log’ program in BillPro

- The primary source for all records in the Bad Debt Log is the Medi-Cal SCPI remit file.

- Only ‘Crossover’ records are extracted from the SCPI files.

- The ‘RA Date’ is the date when Medi-Cal approved the Crossover claim for payment or cutback.

- This system is capable of storing records for multiple NPI numbers in a single-searchable database. This is especially handy for CBOs that oversee multiple hospitals.

- As part of this application BillPro automatically processes the Medi-Cal Share of Cost. This new requirement was set forth in a letter to providers dated Jan. 27, 2012. The letter states that the 2% SOC estimate that has been used in Calif for over a decade is no longer acceptable and going forward, providers must determine the actual SOC. For future logs and audits it is recommended that providers print and store POS info for all Medi-Cal patients.

- In order to process the SOC we would need the applicable UB04 claims. We recommend sending the UB data, via ANSI-837 format, shortly after they’re billed to Medi-Cal in case some are approaching the filing statute. Eligibility Responses cannot be retrieved after 1 year from the DOS.

- Since SCPI files do not contain 100% of the info necessary for the completion & filing of a Bad Debt Log, the missing components are found in the following two sources:

- UB04 claim --> Eligibility response printouts: EVC#, SOC

- Medicare RA --> TOB, HIC#, Medicare RA payment date

- If data is missing in any of the columns it means that we do not have the UB04 and/or the Medicare RA.

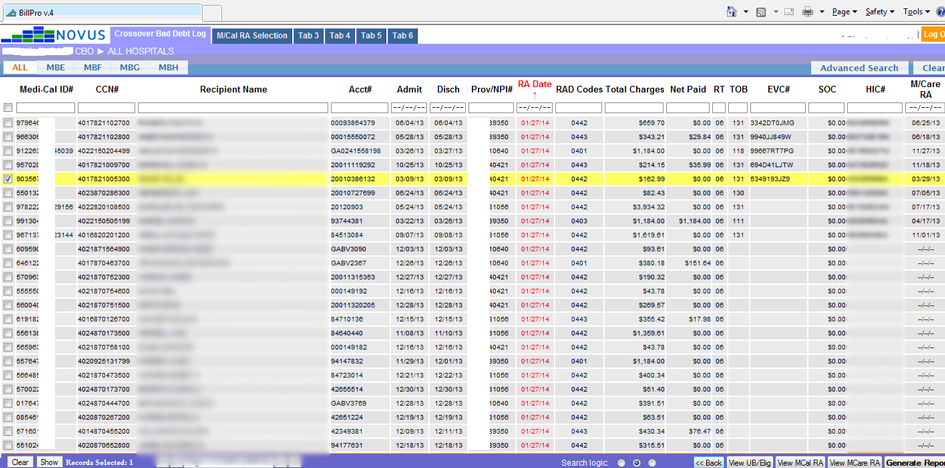

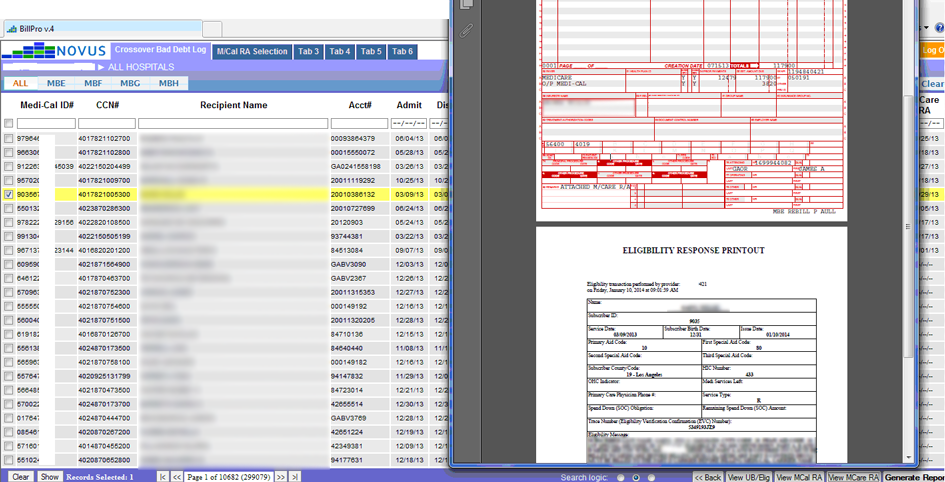

- In the highlighted row below it appears we have all components. Indicators: The EVC# field contains data (i.e. we have the UB), and so does the HIC# & M/Care RA (i.e. we have the Medicare RA)

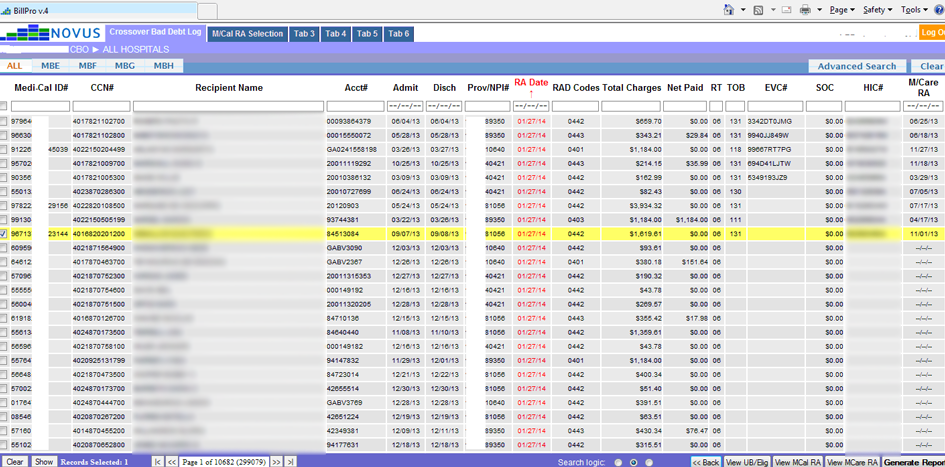

- In Figure 1 below, the record shown in the highlighted row appears to be missing a UB04 claim (i.e. empty EVC# field)

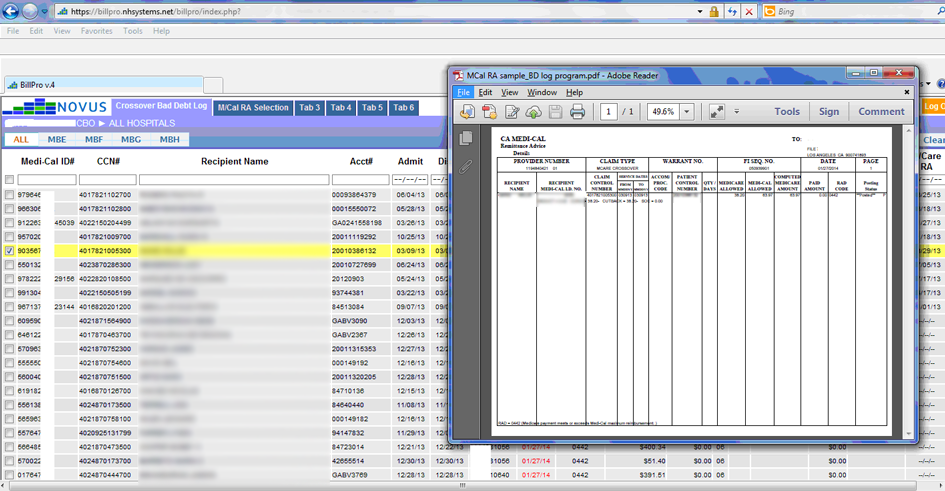

- In Figure 2 below, the record shown in the highlighted row appears to be missing a Medicare RA (i.e. empty HIC# and M/Care RA fields)

FIG. 2

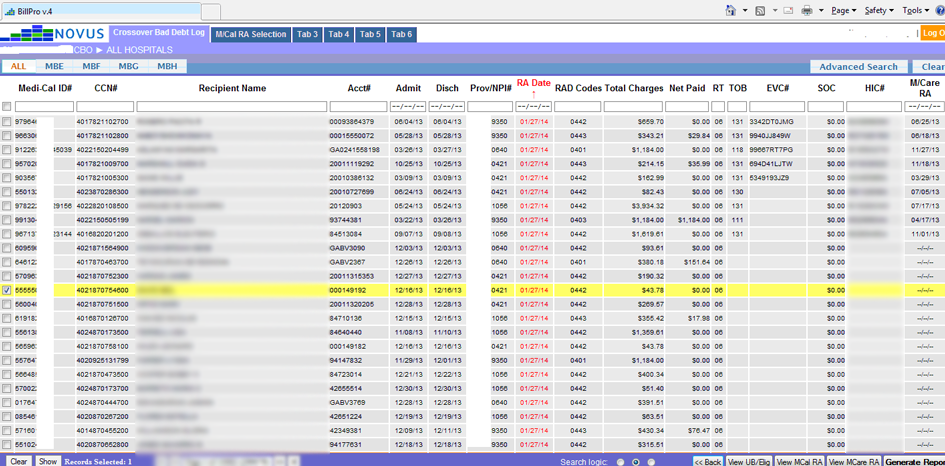

- Users can perform searches, tag records and with the click of a button view the applicable UB & Elig response, Medi-Cal RA and Medicare RA

- In Fig. 3 below we’ve tagged a record (see highlighted row) and clicked the ‘View UB/Elig’ button to produce a PDF that contains the applicable UB and Eligibility Response printout.

- In Fig. 4 below we’ve tagged a record and clicked the ‘View MCal RA’ button to produce a PDF that contains the applicable Medi-Cal RA where this Crossover was approved for payment/cutback.

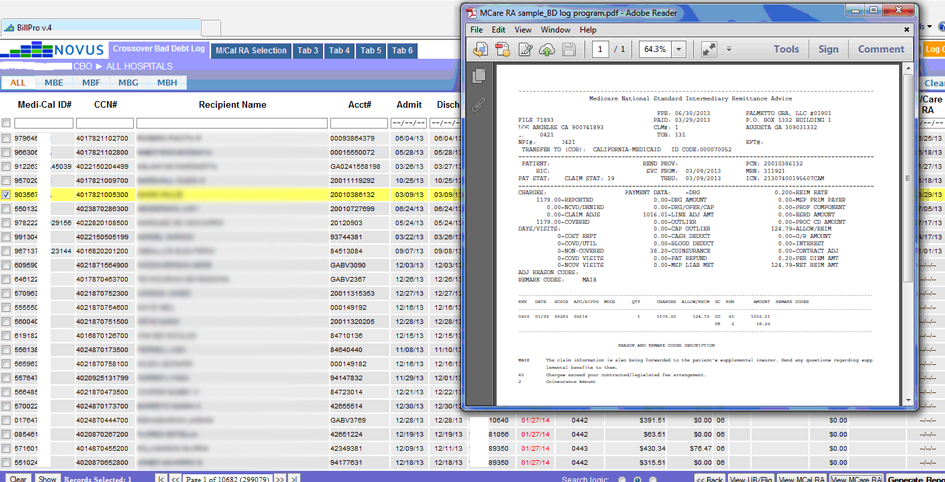

- In Fig. 5 below, I have tagged a record and clicked the ‘View MCare RA’ button to produce a PDF that contains the applicable Medicare RA where this claim was initially paid prior to the crossover to Medi-Cal.

FIG. 4

FIG. 5

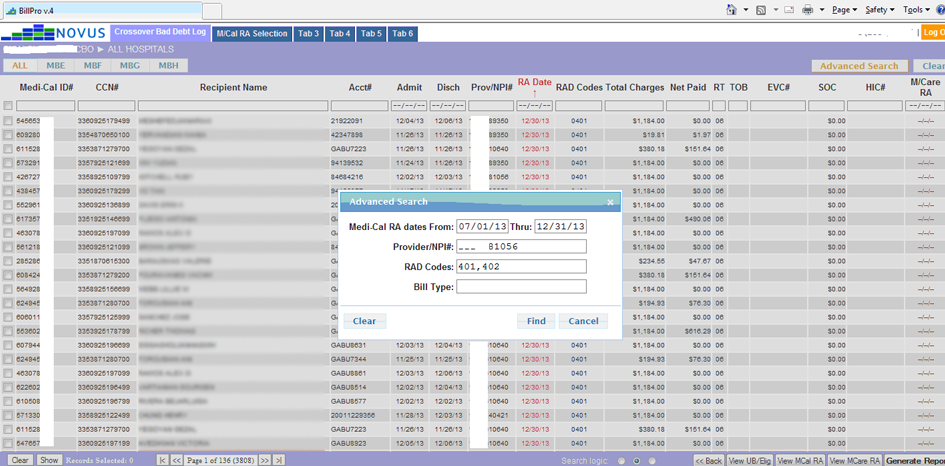

Creating a Bad Debt Log cost report

- Click the ‘Advanced Search’ button and specify some criteria, such as a Medi-Cal date range (see Fig. 6)

- Then click the ‘Generate Report’ button in lower-left corner to export all matching records to a properly-formatted spreadsheet (see Fig. 7)

FIG. 7

Things to remember regarding the Crossover Bad Debt Log:

- It is mandatory for this schedule to be recorded on an electronic spreadsheet such as Excel.

- Valid RAD codes are 0401 and 0402.

- Medicare will not pay bad debts related to Share of Cost (SOC), and any amount of SOC must be eliminated from the bad debt log.

- The Patient’s Share of Cost is not always available from the Medi-Cal RA.

- Keep a good legible copy of the Medi-Cal remittance advice with the bad debt listing.